For the landlord, receiving rent prematurely can present quick liquidity and monetary security. However, it also imposes an obligation to offer the rental service for the period of the prepayment, which may be seen as a liability. A real-life case examine https://www.simple-accounting.org/ that highlights the significance of prepaid lease involves a small manufacturing firm.

How Do You Journal Entry Prepay Account?

If the lessee’s group decides to make a fee before it’s due, there could proceed to be an impressive stability in the clearing account till the lease accounting entries catch up. Oftentimes, this entry should not be adjusted in lease accounting software program and can clear itself up in the following month. Businesses can observe prepaid and accrued bills utilizing card data and accounting software program to ensure GAAP and IRS compliance.

Consolidation & Reporting

The IFRS Conceptual Framework referenced above defines a legal responsibility as “… a gift obligation of the entity to transfer an economic resource because of past events” (para four.26). We wish to go to the Worldwide Financial Reporting Requirements (IFRS) Conceptual Framework for our reference level in definitions. It defines an asset as “… a gift economic useful resource controlled by the entity or person on account of previous events” (para 4.3).

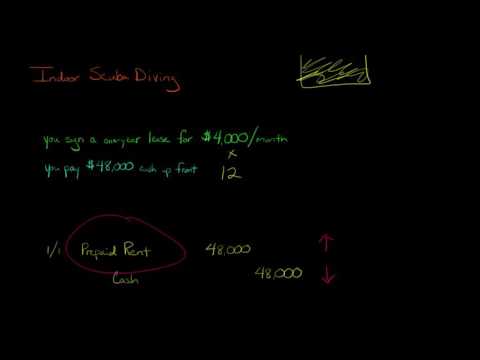

Timing is an important consider recognizing pay as you go lease as a end result of the lessee pays the lessor and the lessor receives payment exterior of the time interval for which the payment is made. When you make the cost, you debit the Prepaid Hire asset account to extend its balance. Since the hire isn’t technically incurred till you occupy the space for that month, the initial cost needs to be recorded as an asset first. Of the whole six-month insurance coverage amounting to $6,000 ($1,000 per month), the insurance for four months has already expired. In the entry above, we are literally transferring $4,000 from the asset to the expense account (i.e., from Pay As You Go Insurance to Insurance Coverage Expense).

By doing so, they can secure a major location and concentrate on operating their enterprise with out the month-to-month burden of rent funds. Prepaid hire additionally permits retailers to price range their bills more successfully, as they can allocate funds for different operational needs. As every month passes, a portion of that asset will get “used up” and turns into an expense in your earnings assertion. This means it’s a balance sheet account that represents a future benefit you’ve paid for however haven’t used up but.

For people, pay as you go lease may not have important tax consequences until it pertains to a home workplace or rental property. The IRS generally requires businesses to capitalize and amortize prepaid bills over the interval of profit, which can affect the timing of deductions. For accounting functions, each prepaid expense and deferred expense quantities are recorded on a company’s steadiness sheet and also will have an effect on the company’s income statement when adjusted.

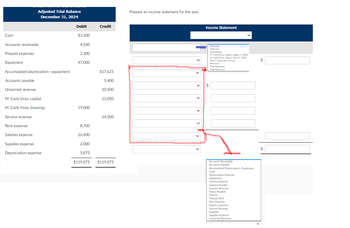

The reporting of pay as you go hire in financial statements is a mirrored image of a company’s strategic monetary planning and its commitment to transparency. In the steadiness sheet, pay as you go lease is offered under current property, indicating that the corporate expects to utilize the rental advantages inside the subsequent year. This placement among assets is essential because it informs traders and collectors about the company’s short-term monetary commitments and its allocation of resources. The clarity of this data can affect lending selections and the assessment of the company’s liquidity.

- It’s like shopping for live performance tickets months in advance—not an expense until you’re in the front row, singing alongside on the prime of your lungs.

- This means businesses can streamline worldwide transactions with out worrying about change rates or third-party charges, making international procurement easier.

- For instance, if you pay for a yr’s price of insurance coverage premiums upfront, the total amount is considered a pay as you go expense till the insurance is used.

- From the perspective of a enterprise owner, ensuring that pay as you go hire is appropriately accounted for is essential for understanding the company’s financial position and for planning future expenditures.

- The prepaid lease (asset account) shall be lowered by 1,000 (7,000/7) each month and the quantity shall be debited to rent (expense account) for each month.

- While this may appear easy and gets the money out of your bank account mirrored, it creates a cascade of inaccuracies in your monetary reporting.

The pay as you go rent (asset account) will be lowered by 1,000 (7,000/7) every month and the quantity shall be debited to hire (expense account) for each month. Prepaid lease is rent that’s been paid prematurely of the period for which it’s due. Under ASC 842, the concept of pay as you go hire doesn’t exist; however, in follow it’s common for lessees to make hire payments in advance. This signifies that taking observe of when pay as you go hire is paid and making certain it’s recorded accurately is of paramount importance.

With software program integration, companies achieve higher management, improve compliance, and reduce errors. On the opposite hand, accrued expenses are logged as present liabilities as a end result of they characterize quantities owed for companies already obtained. These are expensed instantly within the relevant interval and later eliminated once payment is made. Pay As You Go bills are a type of present asset that a enterprise uses or depletes inside a yr of purchase.

Pay As You Go bills are a kind of asset that businesses report once they pay for a service or good prematurely of receiving the benefit. This is often the case with insurance coverage insurance policies, tools upkeep contracts, and digital advertising campaigns. In the case of the insurance coverage coverage, the corporate pays $600 each six months, however the expense is allocated equally over the interval it covers. This signifies that the corporate recognizes $100 as an expense each month, somewhat than paying the full quantity upfront. For example, if your tax 12 months ends on December 31st and also you pay $120,000 on January 1st for 12 months of rent, the complete quantity is deductible inside that yr.

Everlasting accounts are accounts on the steadiness sheet, which embrace transactions related to belongings, liabilities, and equity. Simply like other prepaid expenses (looking at you, pay as you go insurance), pay as you go rent is recorded as a debit. As A Outcome Of whenever you make that upfront payment, you’re growing an asset—specifically, the prepaid rent asset account. From the attitude of a tenant, allocating pay as you go lease over the lease time period entails a monthly recognition of rent expense. The acceptable accounting remedy for pay as you go lease and hire expense could vary depending on the company’s particular circumstances and the rental agreement’s phrases. Every month the prepaid rent account is decreased by the amount of rent paid for that month.